Precious metals have long been considered a stable investment, offering both portfolio diversification and wealth protection. Among these, gold and silver coins are some of the most accessible and popular ways for investors to gain exposure to the tangible value of precious metals. Knowing the difference between bullion and numismatic coins is critical to make savvy investment choices. This article will delve into the nuances of these two categories of coins to help potential investors understand where the best opportunities for value exist.

Precious metals have long been considered a stable investment, offering both portfolio diversification and wealth protection. Among these, gold and silver coins are some of the most accessible and popular ways for investors to gain exposure to the tangible value of precious metals. Knowing the difference between bullion and numismatic coins is critical to make savvy investment choices. This article will delve into the nuances of these two categories of coins to help potential investors understand where the best opportunities for value exist.

Understanding Bullion Coins

Bullion coins are minted with a primary focus on their precious metal content. Their value is closely aligned with the current market—or spot—price of gold, silver, or other precious metals they are composed of. Investors favor bullion coins for their liquidity and the ease with which they can be bought and sold at prices close to this spot value.

A chief merit of bullion coins is their simplicity. They are straightforward investments: when the value of gold or silver increases, so does the value of the coin. Also, because they are minted with the intention of investment rather than as currency for commerce, they come with a guarantee of purity and weight from the issuing mint. This makes bullion coins a practical option for those looking to invest efficiently in precious metals without venturing into more speculative or diversified domains.

Numismatic Coins: Collector's Pieces

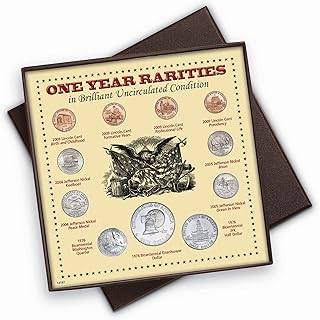

Numismatic coins are distinguished by their collectible value over and above the intrinsic worth of the metal they contain. Their price is predicated on factors such as rarity, historical interest, condition, and demand among collectors. While some numismatic coins can represent incredible investment opportunities, their markets can be unpredictable. The subjective nature of what makes a coin valuable to collectors means that sometimes even small details can drastically affect a numismatic coin's price. As such, these coins are often considered more suitable for knowledgeable collectors or those who wish to combine their investment endeavours with a passion for history and artistry.

Investment Strategies and Goals

The choice between bullion and numismatic coins should be influenced by your individual investment goals. For a more speculative investment with the potential for high returns derived from market demand and scarcity, numismatic coins can be rewarding. Nonetheless, they entail greater risk and require a deeper understanding of the coin collecting market.

Conversely, for those interested in a more straightforward investment, which tracks the value of precious metals in the global market, bullion coins are the preferred choice. It's an investment strategy that banks on the enduring value of metals like gold and silver, offering a hedge against inflation and economic uncertainty.

Advantages of Focusing on Bullion Scrap Value

To maximize returns, savvy investors often prioritize the gold or silver content—referred to as the scrap value—in bullion coins. The approach is to acquire these coins when the prices are closest to their intrinsic metal value, oftentimes through bulk purchases. This strategy reduces the price over spot, which is the small percentage typically added to the price of bullion coins to cover minting and distribution costs.

GoldBroker, a reputable source in the precious metals market, provides investors access to a variety of bullion coins at competitive prices. Monster Boxes, which contain tubes of coins from the mint, are an example of a bulk purchase option that brings the cost per coin closer to spot price.

Popular Choices in Bullion Investing

1 Ounce Philharmonic Coins and 1 Ounce Maple Leafs are amongst the most popular bullion coins available, recognized for their 99.99% purity and worldwide acceptance and liquidity. The high purity level of these coins contributes to their desirability, ensuring that investors are getting the most metal for their money.

Considering Gold and Secure Storage Options

For those interested in gold investment, options such as South African Krugerrands and Canadian Maple Leafs are accessible in various weights and denominations. These coins boast not only a storied history but are also available with secure packaging to guarantee the safety of the investment.

GoldBroker offers investors peace of mind with secure storage options that are not reliant on the banking system, providing a safeguard for your assets. Secure storage is an integral part of investing in precious metals, ensuring that your investment is protected against physical theft and other risks.

Navigating Taxation

Investors should also be aware of the potential tax implications associated with owning and selling gold and silver coins. The tax laws can be complex and differ based on your jurisdiction. Understanding these laws is imperative to making the most out of your investment and avoiding unnecessary tax liabilities.

The Enduring Value of Gold and Silver

Gold and silver have been coveted for thousands of years, holding an esteemed position as the world's oldest forms of currency. These precious metals have weathered economic downturns and market volatility, solidifying their status as a prudent investment choice.

Making Informed Investment Choices

For individuals seeking to augment their investment portfolios or to hedge against economic uncertainties, gold and silver coins present a compelling option. Those prioritizing the metal content of bullion coins can capitalize on the consistent and reliable value of gold and silver, while collectors and enthusiasts might find the unique attributes of numismatic coins engaging and potentially lucrative.

GoldBroker provides not only the means to acquire high-value bullion coins but also the necessary resources to store and understand the tax implications of these assets. By combining informed decision-making with a focus on intrinsic metal value and secure storage, investors can maximize their returns and guard their legacy for generations to come.

Information for this article was gathered from the following source.